The Real World Asset Thesis: The Next Generation of Traditional Financial Markets

Introduction: Assessing Current Reality

Overview of the entire real world asset (RWA) vertical.

The invention of the printing press drove the birth of the Renaissance, by enabling permissionless distribution of knowledge, now blockchain technology has unleashed the forces that will power the next wave of financial markets evolution. The trustless distribution of value is upon us, facilitated by cryptographically secured distributed public ledgers providing a single source of truth for global value exchange.

Distributed state machines have proven incredibly resilient architecture for value transfer which now supports over $1.6trn of total on-chain asset value, with real-world assets making up less than 10% ($132bn). However, the total value of on-chain assets pales in comparison with the off-chain traditional assets. To put this in perspective, a 1bps (0.01%) daily increase in the total off-chain traditional asset market value is equivalent to the entire on-chain real-world asset market doubling overnight.

Comparison of on-chain vs off-chain market sizes.

The emergent programmable on-chain asset class can support much more than its own weight, enabling faster and cheaper value transfer rails has the potential to be the settlement layer for existing off-chain real-world assets. In addition, public ledgers enable greater asset transparency and liquidity, thus reducing investor risk and borrower cost of capital. A holy grail of any capital market participants. This opportunity is most evident in real-world asset tokenisation.

The next wave of evolutionary change in traditional financial markets and beyond is taking us from physical analog to virtual digital. Driven by standardisation (SWIFT, ERC20), decreased settlement times and settlement cost.

Tokenisation, an evolution of securitisation, is a real-world use case for encoding existing off-chain asset metadata in a digital token state. This new tokenisation paradigm will increase asset liquidity, lower distribution costs and reduce settlement times. The value of increased capital efficiency is increasingly relevant in light of higher opportunity cost of elevated money market rates.

Components of RWA Tokenisation across physical asset & digital state.

While today’s most successful on-chain tokenisation use case of stablecoins contributes less than 10% of the $1.6trn total crypto market value, the expected total value of tokenised assets is expected to grow to $6.8trn by 2030.

RWA Growth Potential. Source: 21.co, Citigroup, IMF.

In order to successfully bridge the off-chain and on-chain worlds, the battle-tested innovations of blockchain infrastructure and DeFi protocols must incorporate the long-standing safeguards and best practices of the traditional financial system. These safeguards include regulatory compliance, KYC/AML checks, selective privacy, enforceable controls, quality assets and secure custody. Despite these added complexities, Institutional DeFi is solving this through new token standards (ERC-3643), permissioned on-chain liquidity pools (Ondo Finance), private blockchains (JPMorgan Onyx) and increasing regulatory clarity (Hong Kong SFC).

This evolution is unlocking a new dimension for real-world assets, transforming the financial landscape in a way that seamlessly integrates the agility of David with the strength of Goliath.

Past: Evolution of Real World Assets (RWA)

Although the force of positive change are inevitable, real evolution and adoption of Institutional DeFi takes time. In a similar way, the acceptance of early printed books was limited by both the literate audience and distribution channels, which later were solved through education and technology. The early cycle of innovation first amplifies the radical voices that were previously silenced, which increases the resistance to consensus-led mass adoption. Institutional DeFi is destined to follow a similar meandering path carving out new channels of tokenised value distribution in time.

Ray Dalio Blueprint for Bridgewater’s success.

The History of Ethereum & Real World Assets

The genesis story of bringing real-world asset value on-chain goes back to the 2014 Ethereum whitepaper, proposing an idea of token system applications ranging from sub-currencies representing assets such as USD or gold to company stocks. The vision of distributed consensus systems was to provide a new decentralised single settlement layer for standardised, programmable and composable assets and applications.

However, the early 2017 wave of Initial Coin Offering (ICO) and Direct Exchange Offerings (DEO) was met with resistance of inadequate infrastructure, regulatory headwinds and poor on-chain asset quality. At the time, the majority of on-chain token digital assets were used for speculation, with the underlying value driven by highly reflexive closed system activity. Trading $AAVE tokens on Uniswap and lending $UNI tokens on Aave exemplified the pinnacle of the early DeFi ecosystem.

As a result, the on-chain token speculation use case has helped to stress test and incentivise rapid pace of innovation of the existing DeFi protocols. On-chain value creation has financed an extensive multi-chain network of secure, interoperable and efficient networks paving the way for real-world asset adoption.

The recent technical upgrades of rollup-as-a-service (RaaS), EIP-4844 and account abstraction have improved network throughput and user experience, initiating the transition from dial-up to broadband era. This increased resilience of DeFi was most evident during the 2022 market deleveraging, with centralised (CeFi) digital asset venues acting as the most vulnerable infrastructure (3AC, Celsius, FTX) were as DeFi protocols executed exactly as programmed in a transparent manner.

CeFi risk profile can be mitigated by real-time on-chain auditability.

DeFi Protocols reduce marginal costs

Distributed ledgers and programmable token assets enable a trustless, secure and highly efficient transfer of value for trillions of traditional assets across equities, debt, private credit and many other asset classes previously settled on centralised fragmented ledgers. Early results show an up to 90% reduction in the cost of bond issuance when using blockchain-based record keeping and an up to 40% reduction in fundraising costs, through the elimination of intermediaries and smart contract automation. In addition, tokenisation increases liquidity and lowers cost of capital by unlocking new distribution channels and lowering access barriers through fractional on-chain ownership.

DeFi protocols have superior marginal costs. Source: IMF

The next wave of Institutional DeFi evolution, which combines the innovations and efficiency of DeFi protocols with the safeguards of the traditional finance industry, will result in on-chain bifurcation between regulated permissioned and unregulated permissionless protocols and tokenised asset liquidity pools. Which will provide the needed control, security and regulatory compliance for institutional investor DeFi participation and the associated real-world asset liquidity.

The Rise of Institutional DeFi Infrastructure

The difference between DeFi and Institutional DeFi.

As recently illustrated by JPMorgan’s Project Guardian, which working alongside Monetary Authority of Singapore (MAS) is looking to offer tokenised real-world assets of WidsomTree funds on a decentralised public blockchain Avalanche. In addition, a Societe Generale backed project SG-FORGE has successfully issued its first tranche of tokenised green bond to permissioned institutional investors (AXA) via a public Ethereum blockchain.

Looking ahead, the path of Institutional DeFi bifurcation will be largely determined by the degree of real-world asset evolution along the spectrum of tokenisation. The nature of asset ownership representation and enforcement along with value exchange locality between centralised off-chain and decentralised on-chain ledgers, will determine the extent of regulatory and compliance issuance requirements. As highlighted in the recent report by RWA.xyz, the regulatory appreciation of tokens as bearer assets represents the most significant step toward digitally enabled financial markets.

This evolving scenario sets the stage for our next discussion on the present state of Real-World Assets (RWA) in this rapidly transforming landscape.

Present: The State of Real World Assets

The current landscape of on-chain real-world assets, although still in its nascency, is already showing signs of the diverse and flourishing ecosystem. The parallel evolution of the institutional DeFi infrastructure and the spectrum of digital asset tokenisation is converging into an interconnected network of on-chain liquidity across previously fragmented off-chain asset classes.

A network of public and private blockchains is creating a new efficient value exchange and settlement layer for tokenised real-wold assets such as bank deposits, government debt, private credit, equities and commodities. This settlement layer is steadily becoming a unified source of truth for trustless store and exchange of value across both digital and physical assets. Every real-world asset is now finding its very own on-chain digital asset twin.

Overview of the RWA ecosystem across public and private infrastructure.

This on-chain RWA ecosystem is enabled by the significant improvements in the multi-chain DeFi infrastructure that provide a secure, efficient and standardised settlement layer for emergent digital assets. We are seeing new token standards (ERC-3643), chain-specific permissioning (Avalanche Subnets), institutional private tokenisation layers (Onyx) and privacy-preserving interoperable solutions (zkEVM) as enablers of institutional DeFi infrastructure. In the process, decentralising the backend of traditional financial markets and eliminating costly intermediaries.

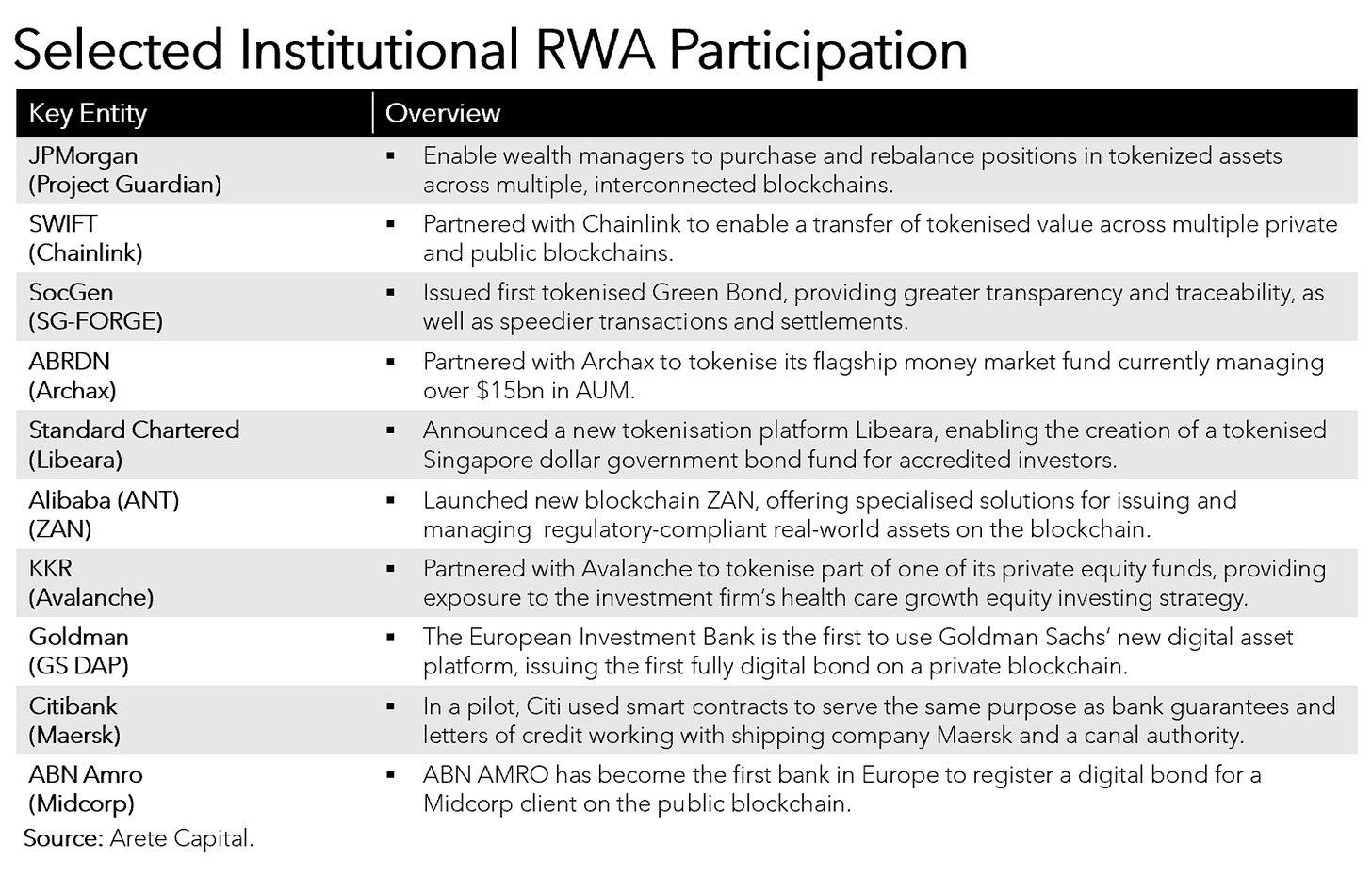

The full evolutionary force of real-world asset tokenisation is best illustrated by the increasing ecosystem participation of the major traditional finance institutions. Despite the ongoing regulatory and macroeconomic headwinds, institutional sell and buy-side investors such as JPMorgan, SocGen, Goldman, KKR Citibank and ABN Amro are allocating significant time and resources to launching products on private and public blockchain infrastructure. These tokenised financial products cover a broad spectrum of off-chain asset types, from highly liquid short-duration money market funds to less liquid maritime letters of credit.

Taking aside the changing headwinds of US-led macroeconomic forces, the global regulatory landscape is showing significant evolution in setting the base for the institutional issuance and adoption of tokenised real-world assets. Sovereign regulatory bodies such as Hong Kong SFC, UK FCA and Swiss FINMA are working with traditional and digital industry practitioners to formulate regulatory frameworks, guidance and sandbox environments. As the regulatory landscape matures, we expect to see greater on-chain institutional capital participation along with a Cambrian explosion of the RWA ecosystem.

Having set the scene for the on-chain real-world asset ecosystem, we will now focus on the prevailing tokenised digital asset segments.

Stablecoins: The First on-chain RWA

The early emergence and adoption of stablecoins was facilitated by the difficulty of offshore centralised exchanges in obtaining fiat banking accounts and the investor’s demand for uncorrelated stable digital assets that enabled effective risk management. As a result, USD fiat-pegged stablecoins achieved an instant product market fit. In the true spirit of DeFi, initial iterations of stablecoins relied entirely on on-chain asset backing, either via overcollateralised debt position (DAI) or algorithmically rebalanced (un)stable tokens (Terra). Meanwhile, centralised entities such as Tether and Circle chose a different path of tokenising USD off-shore (Eurodollar) and on-shore (SVB) bank deposits, effectively bridging real-world asset liquidity on-chain.

Despite some recent challenges, time has proven the latter tokenised real-world bank deposits model to be more resilient and economic in facilitating stable on-chain payments and serving as the backbone to DeFi trading and lending infrastructure.

Stablecoin dominance over time. Source: 21.co, DeFi Lama, Keiko

While the total tokenised real-world bank deposits (USDT, USDC) today represent just under 10% of the entire digital asset market size ($1.6trn), the stablecoin market is expected to surpass $2.8trn over the next five years. This growth will be powered by operational tailwinds of faster and cheaper value exchange and settlement, enabled by secure decentralised infrastructure (Ethereum, Bitcoin) and scaled by high-throughput Layer 2 solutions (Arbitrum, Lightning). In addition, the integration with TradFi consumer platforms (PayPal) and issuance of regulated non-USD denominated stablecoins (Allunity EUR) will further broaden the tokenised product distribution and facilitate more efficient cross-border payments.

On the demand side, stablecoins will always serve as a natural on-ramp to the digital asset ecosystem while also providing a much-needed stability and security to millions of people living in less economically stable jurisdictions (Venezuela, Turkey, Lebanon).

Despite their success, stablecoins are entirely depended on the perceived and actual value of the underlying real-world tokenised assets. As non-bank entities, the issuers such as Tether and Circle are not subject to the same level of transparency requirements and regulatory oversight as imposed on banks, thus exposing them to intermittent crisis of confidence and a resulting on-chain price pressure.

This was evident in USDT weight imbalance in Curve 3pool driven by the perceived exposure to commercial paper securities and the temporary USDC depeg due to the actual exposure to Silicon Valley Bank. Since then, both centralised issuers have increased collateral transparency, improved asset quality and diversified counterparties to reinstill market confidence and pave the way for future adoption.

Focusing on the underlying real-world asset quality, we see major stablecoin issuers increasingly relying on short-term US government bonds as the cornerstone off-chain collateral asset. In particular, we see USDT soaking up offshore dollar liquidity into ‘staked’ US government debt, while in the process capturing the entire net interest margin as token holders do not receive any underlying interest.

This prevailing dynamic is already creating tensions, with the emergence of yield-bearing stablecoins (USDY, USDM, stUSD) that seek to redistribute a greater portion of real-world yield to the on-chain token holders. The resulting tensions enable the convergence between emergent institutional DeFi infrastructure and established, regulated and highly liquid pool of money-like real-world assets.

U.S. Treasuries

Following the stablecoin on-chain adoption success and very attractive net interest margin captured by the off-chain centralised issuers, the next phase of real-world asset evolution has been driven by the tokenised US treasury debt issuance. In the process, capturing the lion’s share of the net interest margin by the token holder though a direct exposure to a low duration, highly liquid and US government-backed real-world asset. Currently yielding 5% (OUSG) versus 0% earned by USDT and USDC token holders, representing over $100bn of value.

The current wave of tokenised treasury adoption is fuelled by the combination of decreased DeFi yield opportunities, due to lower demand for on-chain leverage, and the shifting investor demand for short-duration money-like instruments that benefit from the tight US monetary policy. This trend is also evident in the significant off-chain bank deposit flows into money market funds, driven by low bank deposit rates and exposure to long-duration unrealised asset losses. The emergence of institutional DeFi infrastructure is expected to supercharge this trend of growing global demand for safe, income-generating and liquid real-world assets.

Off-chain flight to low duration yield. Source: BlackRock

Looking at the on-chain data, we see a significant tokenised treasury total value growth ($800m TVL) over the last year. Interestingly, the biggest on-chain issuance came from an established $1.4trn TradFi institution (Franklin Templeton) that offers a tokenised non-transferable US treasury assets on a permissioned app (Benji). The use of secure, transparent and low-cost blockchain infrastructure (Stellar) unlocks significant operational efficiencies and new liquidity, reducing the need for US bank and brokerage accounts for qualified investors.

Total issuance of tokenised U.S. Treasuries. Source: RWA.xyz, Coinbase Research

Another notable tokenised US treasury and money-like on-chain real-world world asset issuance comes from Ondo Finance protocol. By combining a professional asset management arm with institutional-grade DeFi technology infrastructure, the project is enabling transparent, legally compliant and decentralised access to low-risk real-world asset exposure to US and non-US qualified investors. The evident success of the protocol is driven by the on-chain demand for stable real-yield products by DAO treasuries, non-US investors and digital asset funds that seek to take advantage of the high off-chain risk-free rate while preserving the trustless self-custody and composability of their on-chain assets.

In order to accommodate for different investor type and risk preferences, Ondo Finance provides a range of on-chain products (OUSG, OMMF, USDY) that range from bank deposits to tokenised US government money market funds. While each sharing an institutional-grade off-chain infrastructure layer (Blackrock, BNYMellon, Clear Street), the on-chain product distribution is partitioned in a permissioned regulatory-compliant structure using geographical restrictions and qualified investor wallet whitelisting. This hybrid structure bridges the best practices of TradFi with the technological efficiencies of DeFi.

In addition, emerging on-chain treasury protocols like Matrixdock, Backed, Maple, Hashnote and Mountain are enabling qualified investors to earn risk-free yields backed by US treasury securities. Their integration with the public Ethereum blockchain facilitates T+1 day quick settlement for mint/redeem requests, streamlining transaction processes and unlocking stablecoin capital efficiency.

These protocols also stand out for their interoperability and compliance features. They support freely transferable ERC-20 tokens, ensuring liquidity and easy transfers within the DeFi ecosystem. Their composability with DeFi protocols and multi-chain framework extend their utility across different blockchain networks. Notably, they are designed to be permissionless and composable, promoting an open and interoperable environment. Their institutional-grade, regulated, and transparent nature assures a high level of security and compliance, catering to the needs of a diverse range of users in the DeFi ecosystem.

In addition to new protocols, the second biggest and one of the oldest DeFi protocols MakerDAO has also recently decided to diversify its DAI collateral holding into on-chain real-world assets. As a result of its 42% allocation to Treasury bills, MakerDAO is earning over $100m in annualised revenue that can be redistributed back to Maker token holders. In addition, the indirect Treasury exposure to Coinbase custodied USDC treasury balance provides incremental revenue tailwinds. Thus making a native DeFi protocol MakerDAO token an on-chain derivative of tokenised off-chain US treasury securities.

MakerDAO T-Bill exposure & revenue. Source: Data Analytics

Private Credit

The growing trend in private credit ($1.5trn+ AUM), fuelled by the retrenchment of banks, is carving a significant niche in the traditional financial landscape. This shift towards non-bank lending offers promising opportunities for private credit funds and other non-bank lenders, drawing substantial interest from pension plans and endowments seeking smoother, higher returns. Additionally, this trend plays a crucial role in dispersing financial risk outside the government-backed banking sector, marking a notable shift in the dynamics of the modern financial landscape.

Growth of Private Credit. Source: BlackRock

The on-chain private credit lending market, which faced significant challenges following bad debts from centralised finance (CeFi) collapses, is now experiencing a resurgence driven by the real-world asset narrative. According to data from RWA.xyz, the total amount of on-chain credit has impressively grown to $590 million, a substantial 130% increase from the previous year. Despite this figure constituting less than 5bps of the traditional $1.5trn private credit market, the current upward trend indicates a promising potential for further expansion in the on-chain credit sector.

On-Chain Private Credit active loans. Source: RWA.xyz

The benefits of on-chain private credit issuance and distribution are most evident in the significantly lower cost of capital, with the current average yield of 6% across top structured credit pools in Centrifuge protocol versus 13% yield across leading off-chain funds. Admittedly this comparison is best suited to like-for-like products, nevertheless the more operationally efficient institutional DeFi infrastructure enables meaningful capital cost savings and new channels of distribution for existing and new private credit products.

Looking at the leading on-chain protocol Centrifuge, each investment pool is anchored by a Special Purpose Vehicle (SPV), separating the asset originator's business from the pool's financing operations and protecting the assets from bankruptcy risks. In case of asset default, the pool issuer is responsible for capital recovery, which may involve substituting non-performing loans and managing collections. Recovered funds are converted to stablecoins and distributed to token holders.

For investor onboarding, the process adheres to strict KYC and AML regulations, including verifying accredited investor status, especially for US-based investors. Centrifuge uses a third-party electronic KYC system to streamline this process. After meeting all regulatory requirements, investors can enter into a subscription agreement with the issuer to join the investment pool.

This infrastructure enables decentralised financing of diverse real-world assets directly on the blockchain, offering a transparent market where borrowers and lenders interact directly, bypassing intermediaries. It supports various asset classes, including mortgages, invoices, and consumer finance, ensuring full collateralization and legal protection for liquidity providers. The protocol's goal is to reduce borrowing costs globally while offering DeFi users a stable, collateralized yield source, independent of the volatile crypto markets.

Goldfinch and Maple are other major on-chain private credit protocols in the institutional DeFi lending space. Goldfinch enables businesses, especially in emerging markets, to access crypto loans using real-world assets as collateral instead of crypto assets. In contrast, Maple offers uncollateralized lending, relying on "pool delegates" to assess creditworthiness and manage loans. While Goldfinch broadens crypto loan access, Maple follows a traditional lending approach where liquidity providers earn MPL interest from their contributions to controlled liquidity pools.

Alternative Real World Assets

The tokenised equity markets in the on-chain RWA space are relatively small, primarily due to the heavy regulation in public markets and the operational complexities of managing physical ownership off-chain. For instance, protocols like Backed Finance, operating under the Swiss DLT act, offer public equity RWAs but must ensure full backing with actual stock ownership, complicating the process of asset transfer and redemption. In contrast, the DeFi space has long embraced derivative and synthetic markets, such as Synthetix, providing an alternative to the more complex equity and real asset RWAs through contractual, non-ownership-based models.

Focusing on on-chain real estate assets, the RealT platform offers an innovative approach by creating a decentralised finance market centered around fractional ownership of US real estate properties. This platform enables investors to gain exposure to the real estate market without the necessity of owning an entire property. It allows real estate owners to sell fractional shares of their properties, thereby providing an opportunity for them to diversify their investment portfolio and reduce the risks associated with complete ownership. This approach democratises access to real estate investments, making it more accessible and flexible for a broader range of investors.

In addition, understanding the nuances between institutional and consumer real-world assets is crucial in the evolving landscape of asset tokenisation. Institutional RWA primarily focuses on scaling capital, whereas consumer RWA aims at expanding the user base. Consumer RWA encompasses a variety of tokenised digital and physical collectibles, including sneakers, cards, watches, wine, and art. Despite their differences, both categories share key features like verifiable ownership, transparency, enhanced liquidity, and the ability for instant trade settlement. The use of primary issuance methods such as airdrops and exclusive mints has proven to be an effective strategy for fostering brand loyalty. Simultaneously, the secondary market exchange introduces a financialization aspect, unlocking a new dimension of customer engagement and value.

Future: The Path Ahead for Real World Assets

As we stand at the crossroads of a digital asset revolution, real-world assets (RWAs) are poised to play a pivotal role in bridging the gap between established traditional financial systems and the realm of emergent DeFi infrastructure. The integration of RWAs into blockchain networks is not just a trend but an inevitable and necessary evolution in traditional financial markets. This integration is expected to catalyse a seismic shift in how we store and transfer real-world asset value, unlocking liquidity and providing unprecedented access to a broader range of investments. With technological advancements and regulatory frameworks evolving in tandem, the path ahead for RWAs is marked by immense potential and a myriad of opportunities for innovation and growth.

The next phase in the journey of RWAs will likely focus on overcoming the challenges of scalability, interoperability, and regulatory compliance. Scalability will be key in managing the sheer volume of transactions that the incorporation of RWAs into blockchain networks will bring. Interoperability between different blockchain platforms will enable a seamless and efficient transfer of assets, enhancing liquidity and market efficiency. Furthermore, establishing robust regulatory frameworks will be crucial in building trust and legitimacy, encouraging wider adoption among traditional investors and institutions. These institutional DeFi applications will not only unlock a new dimension for real-world assets but also pave the way for more inclusive financial systems.

Further Reading

[1]: Oliver Wyman Institutional DeFi Report

[2]: US Fed Tokenisation Overview

[3]: RWA.xyz Spectrum of Tokenisation

[4]: Binance Report on Real-world Assets

[5]: The State of Tokenization - Research | 21.co

[6]: Digital Asset Research RWA Tokenisation Report

[7]: IMF Cryptocurrencies and Decentralized Finance

[8]: Unreal Primer on RWA Tokenisation